Leading the most impactful AI transformations

Trusted by 500+ businesses worldwide

Industries

We apply data and AI in contexts where industry detail really matters. By grounding our work in the realities of each sector, we help organisations build practical, scalable solutions that hold up in real operations.

Build something great together

We help organisations make data and AI work in practice. From defining strategy to building and deploying data and AI platforms, we support the full journey: embedding governance, change, and new ways of working so solutions scale beyond pilots.

About us0+

Countries clients served across

0+

Nationalities on our team

0+

Offices

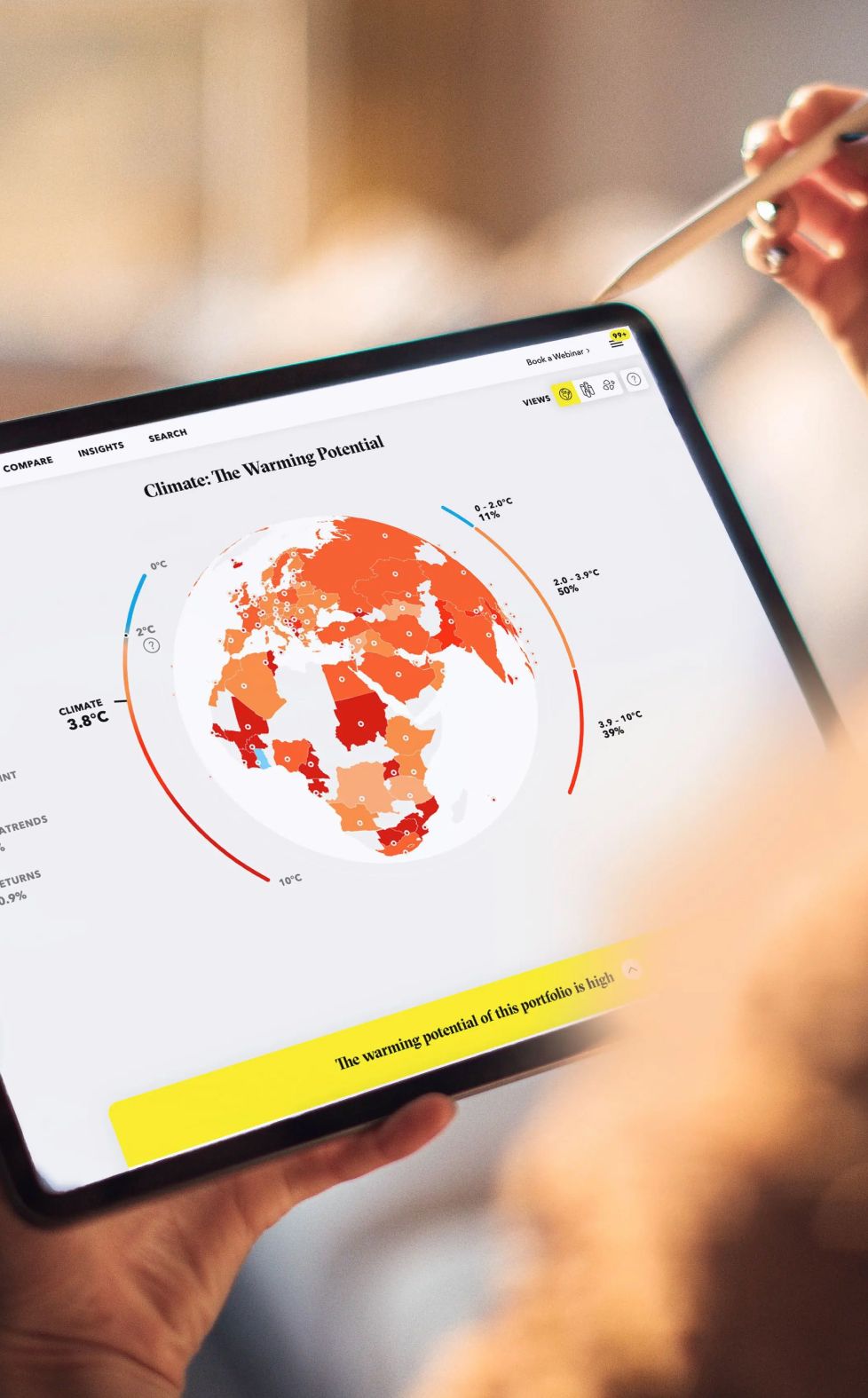

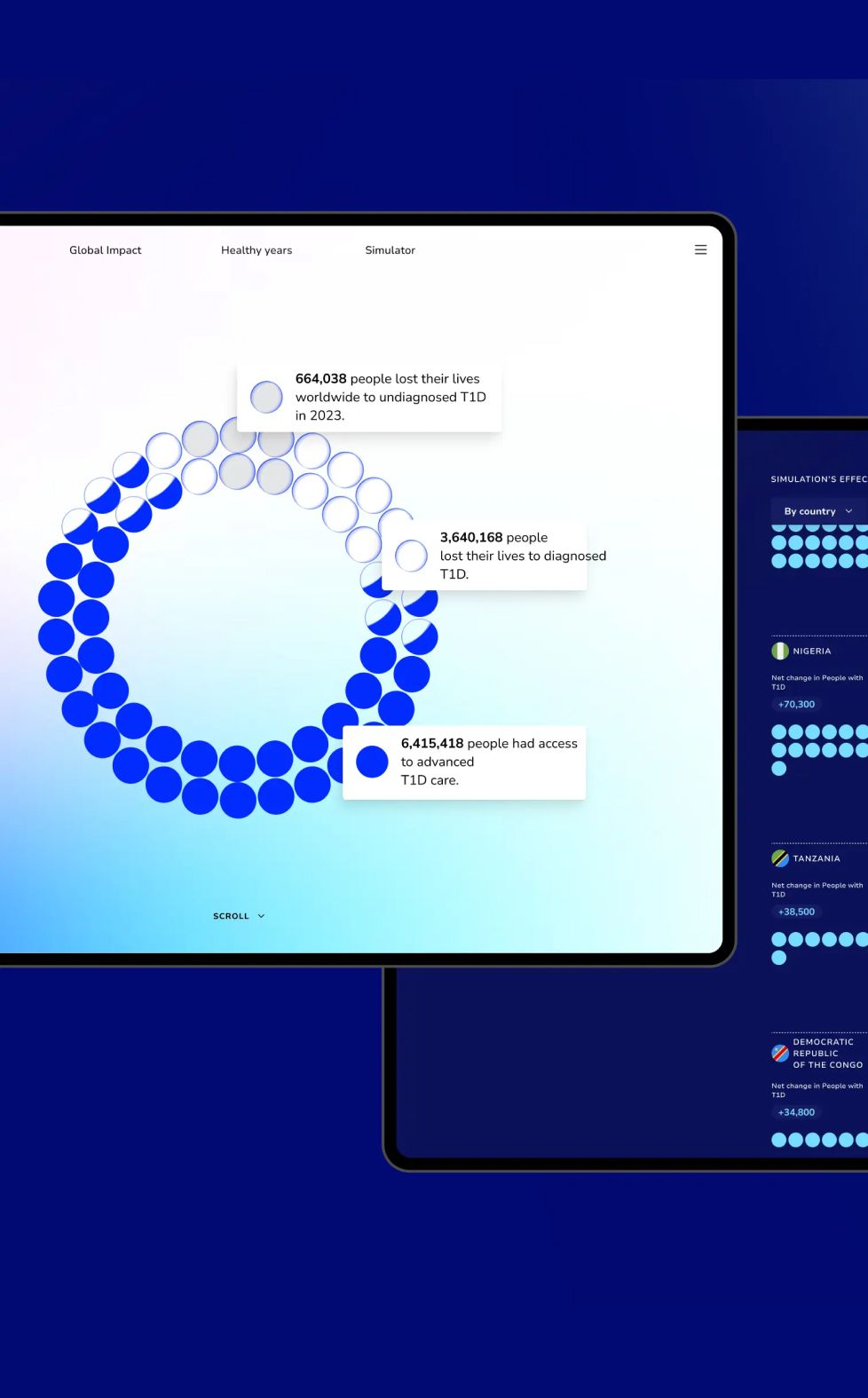

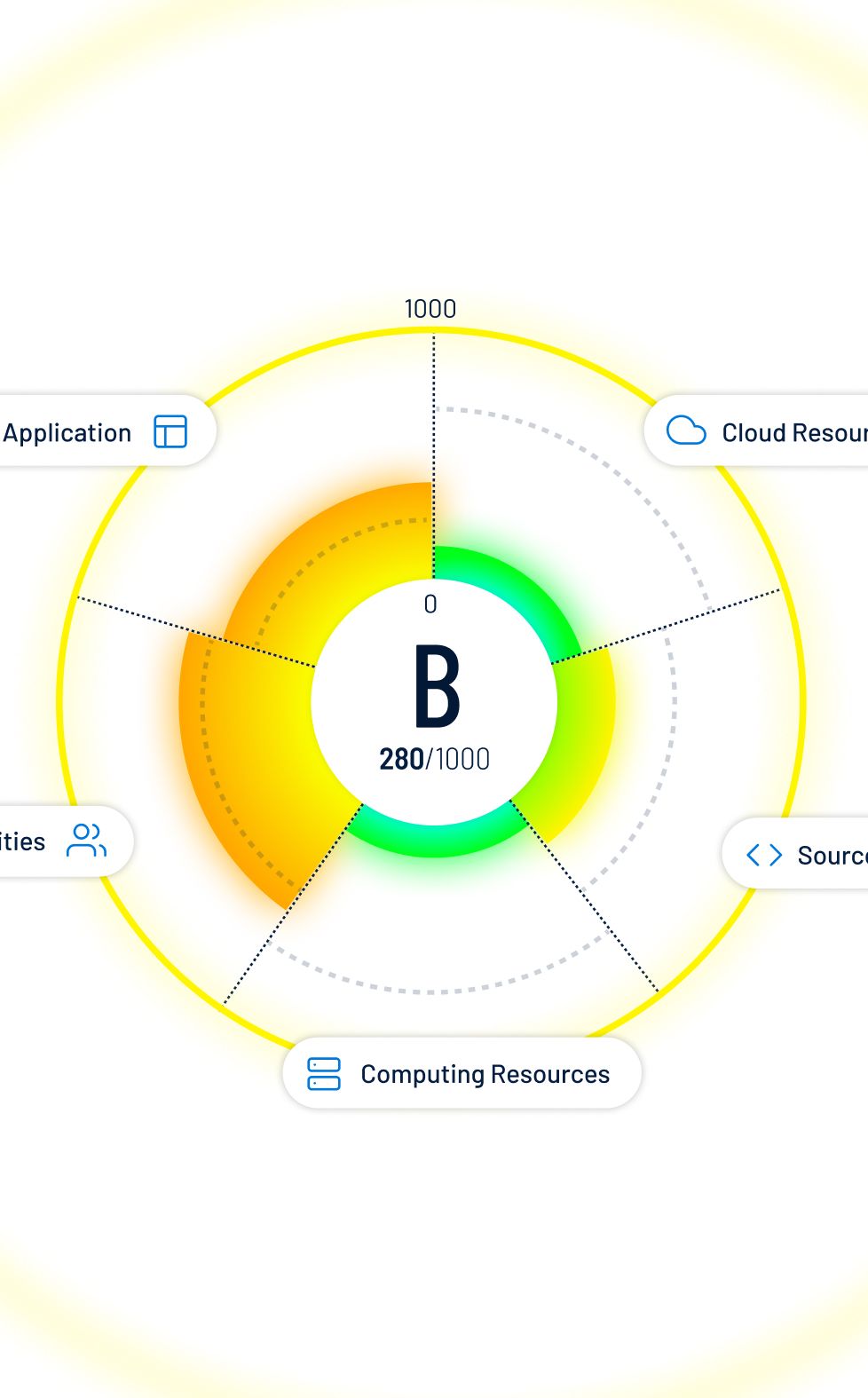

Designing intelligence with CLEVER°FRANKE

We partner with our design studio, CLEVER°FRANKE, to turn complex data into clear, usable experiences. Through interface design, data visualisation, and interaction, we help organisations build trust in AI, support better decisions, and drive adoption at scale.

Featured cases

See how AI has transformed organisations like yours: the problems our clients faced, how we approached them, and what changed as a result.

Life sciences

"They have proven their ability to transform our complex business requirements into a matching technical solution to solve our challenge with a very fast turn-around time, making the project efficient and allowing the experts to work focused on solving the real issues. "

Ibrahim Kamstrup-Akkaoui

Vice President at Novo Nordisk

Latest insights

Explore how AI is reshaping your industry and what we think about it to spark ideas for your own transformation.

Agentic code migration: turning lingering legacy to state-of-the-art software

Agentic code migration uses specialized AI coding agents and governed workflows to automatically analyze, convert, test, and refactor legacy code into standards‑compliant systems, making large‑scale platform and language upgrades faster, safer, and easier for development teams.

EoS pricing: why a solid pricing plan is not enough

End‑of‑Season pricing often looks solid on paper, but breaks down the moment real‑world variables start shifting. When teams can’t recalculate scenarios fast enough, strategy gives way to compromise, leading to margin loss and inconsistent execution.

Pricing Game: test your pricing strategy, without the consequences

Test your pricing strategy in a real-time AI simulation that lets you see the impact of your decisions—without any real‑world consequences.

Connect with our experts

From shaping an AI vision to scaling solutions in production, we work with you as one team to drive AI transformation that truly brings impact.

Contact us