In today’s airline industry, Revenue Optimisation (RO) is no longer just about better forecasting. It’s about continuously adapting to a dynamic and noisy marketplace. Competition is intense. Demand patterns shift in response to macroeconomic tremors, unobservable competitor moves, changes in consumer sentiment, and increasingly complex customer segments. Against this backdrop, airline pricing and revenue management (PRM) leaders face a tricky question: How do we make the best pricing decisions when everything keeps changing?

At ADC Consulting, we believe there are two essential capabilities for answering that question:

Accuracy through novel approaches to historical data analysis:

The application of advanced, causal models to estimate a granular and high-fidelity willingness-to-pay (WTP).

Confidence through experimentation:

The ability to test price interventions and validate new models quickly through structured experimentation (XP).

Separately, each is valuable. Together, they form a continuous learning system that powers more innovative and effective pricing. And that’s what modern Revenue Optimisation is really about.

Revenue Optimisation in a world of noise

Conventional RM systems were designed for a world where historical patterns were stable enough to guide future pricing. But that world no longer exists. Every route, product, and season now unfolds under the influence of volatile inputs: competitor strategies, marketing campaigns, economic shocks, and unstructured signals such as weather and events.

This noise distorts the data, which means that even well-built pricing models can systematically misread the market. That's where the right mix of analytics and experimentation comes in.

Getting price elasticity right

Many PRM leaders are re-evaluating how they estimate customer price sensitivity. Traditional price elasticity models in aviation assume we can observe all the factors that drive both pricing decisions and passenger demand. But we can’t. When models overlook key variables—say, an unobserved competitor fare drop, a regional event shock, or a slow macroeconomic shift—elasticity estimates can become counterintuitive:

- Business travellers appear more price-sensitive than leisure ones

- Elasticity doesn’t flatten near departure

- Fare engines consistently recommend prices that are too high

To address this, advanced teams are turning to causal econometrics:

- Panel data methods (e.g., Interactive Fixed Effects) that capture latent variables without needing to observe them directly

- Double machine learning (DML) to balance flexibility with statistical control

- Instrumental variables (IV) for cleaner separation of price and demand

This is the new standard for scientific price elasticity estimation. But even these models face limits if they only rely on historical data. That’s where experimentation comes in.

Confidence: test, don’t guess

Structured price experiments allow airlines to test hypotheses directly in-market. Done right, they provide clean, causal evidence about how customers actually respond to price changes.

This is especially useful when:

- Launching new products or fare bundles (no historical baseline)

- Exploring price points outside your historical range

- Validating or refining elasticity estimates from models

Advanced experimentation techniques like multi-arm pricing tests, switchback testing, and time-to-departure segmentation make it possible to:

- Map entire demand curves

- Cancel out seasonal or external shocks

- Quantify elasticity with best possible accuracy

Take fare family gaps: rather than debating if a €35 or €50 price gap between Basic and Flex is optimal, test multiple options across routes and segments—and let the data tell you.

The continuous revenue engine

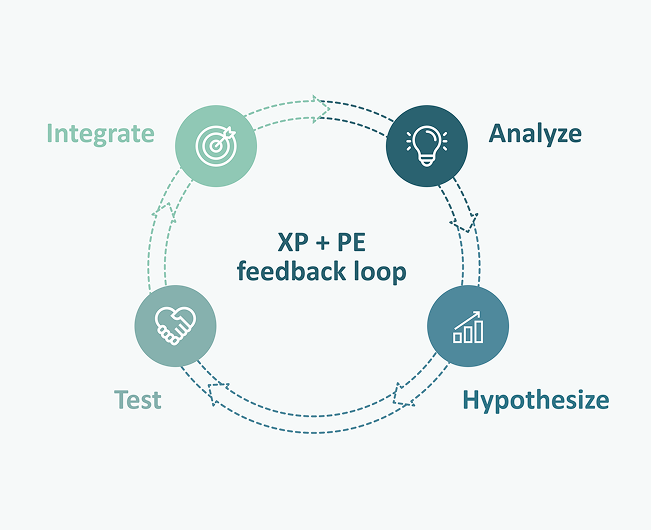

Revenue Optimisation is not a one-time initiative. It’s a system that sharpens itself over time. We call this the XP + PE feedback loop:

Analyse

Use econometric models on historical data to estimate elasticity and flag uncertainties

Hypothesise

Translate those insights into specific pricing ideas

Test

Run controlled experiments to validate or refine the idea

Integrate

Feed results back into your models to update predictions and improve future decisions

This loop not only improves predictive accuracy but also boosts organisational confidence in pricing decisions.

The most innovative PRM teams use this loop to:

- Prevent overpricing that kills demand

- Avoid under-pricing that leaves revenue on the table

- Move faster on innovation, from ancillaries to bundles to dynamic offers

Final thought: the future is adaptive

Even the most accurate elasticity estimate has a shelf life. Markets move. Customers change. Competitors react. The best way to stay ahead is to combine scientific insight with operational agility.

At ADC Consulting, we help leading airlines do precisely that: embed structured, rigorous experimentation and advanced price elasticity modelling into their day-to-day pricing decisions.

This isn’t just better revenue management. It’s what modern Revenue Optimisation looks like.

What stage is your organisation in on its data-driven journey?

Discover your data maturity stage. Take our Data Maturity Assessment to find out and gain valuable insights into your organisation’s data practices.